Small Business Tax Accountant Sydney.

If you are falling behind on ATO compliance, burdened with a significant amount of debt, and facing cashflow constraints, you may be working with an accountant who is a sloth. Fortunately, Oyster Hub has a team of business tax accountants that uses cloud accounting solutions to help clients in saving both their time and money

Jump To

Accounting software we work with

HOW TO GET STARTED

Are you looking for a small business tax accountant who takes a proactive approach in helping you reduce your taxes and prioritise your future goals?

Oyster Hub provides exceptional value to clients by leveraging new accounting strategies, such as cloud accounting and a comprehensive database of over 200 tax strategies. Our goal is to help small businesses reduce costs and maximise profits, allowing them to focus on their core business operations.

See our tax accounting packages which includes annual financial statements, business tax lodgments, ATO BAS lodgement and an annual accounting check designed to meet the unique needs of each business.

- Work With Us

Why Invest in Proactive Accounting Services.

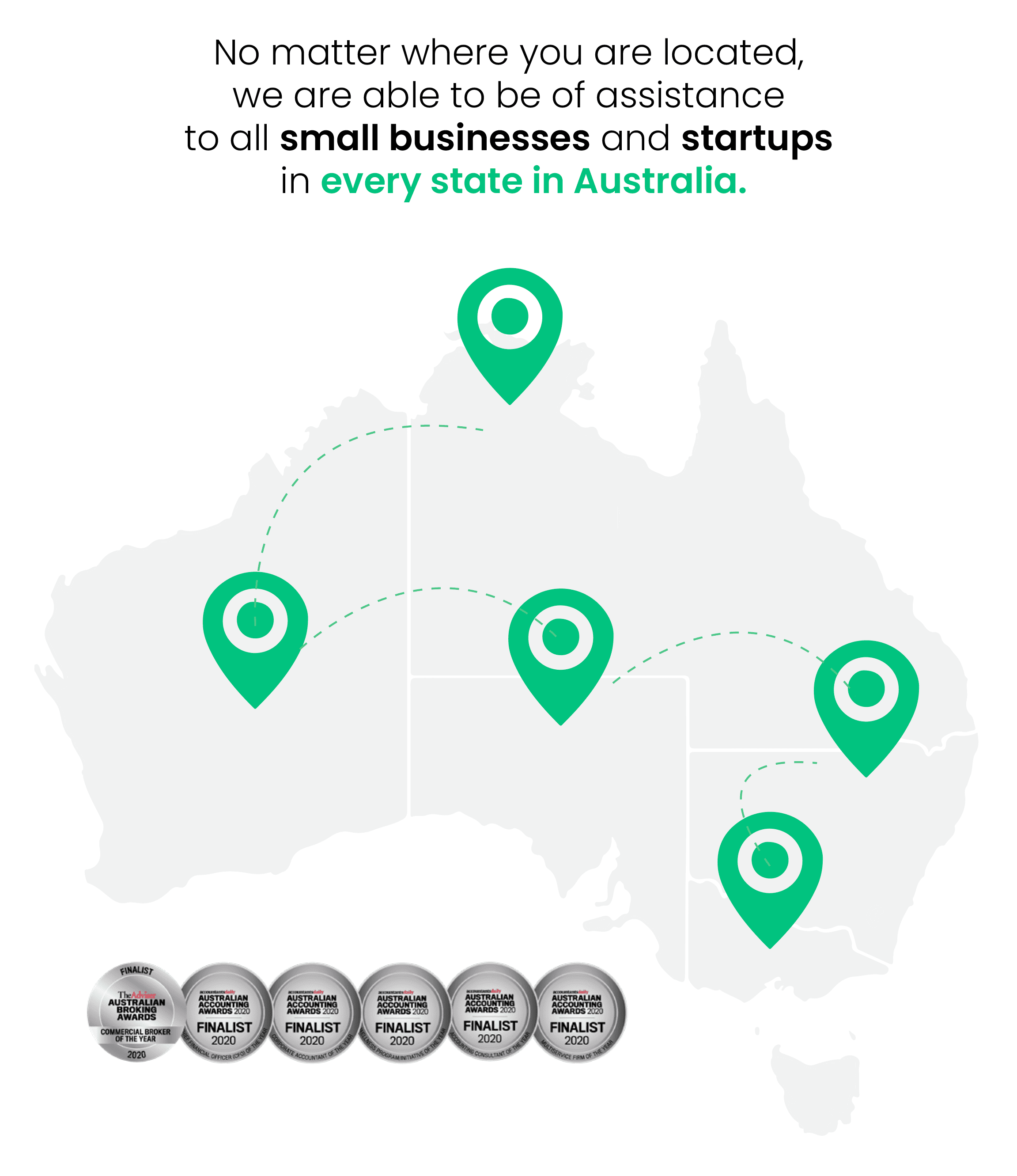

Our team of business tax accountants have helped numerous small businesses and startups transition to cloud accounting and automate their tax, BAS, and ATO reporting. With our extensive accounting solution, your business can now leverage a single system that seamlessly combines all accounting, bookkeeping, and ATO reporting in one streamlined platform— eliminating the need for paperwork and freeing up more time and resources so you can focus on what matters most – growing your business.

ATO Red Zone Compliance Safe

Keep the ATO off your back with our compliance strategies tailored for you. We guarantee that you will never receive a negative ATO call for not complying with your obligations.

Timely access to financial information is critical for making informed decisions about your business, allowing you to focus on taking your business to the next level.

We use cloud-based reporting systems with 24/7 access to your entire business database, enabling you to access data-driven insights for your business at any time, from anywhere.

We help Small Businesses, with Proactive Tax & Accounting Solutions to grow.

Our Sydney accountants at OysterHub provide a broad range of services to meet all the demands of every small business. You can select the level of involvement you want your accountant or bookkeeper to have before committing to our bespoke services. We provide options that range from basic account management to full-service consulting.

We are always available to offer advice when you need to make business decisions, unlike other accounting firms.

01

Meeting Your Business ATO Obligations

Did you know that the majority of our clients who approach us for a second opinion have identified discrepancies or could have potentially attained better outcomes? Our rescue tax accountants have seen firsthand how common it is for businesses to make mistakes or miss out on opportunities when it comes to tax compliance and planning. Call us and discover the benefits of working with a trusted partner for all your business tax needs.

You need to lodge an income tax return each year to report your business income and claim deductions. You may also need to lodge other yearly reports or returns if you are registered for other tax types. Tax returns cover the financial year from 1 July to 30 June.

Our approach is to review you business accounta t and find possible tax savings before we preapre any tax returns for small buisness.

If you are operating as a small business our small business tax accountant can help you with :

- Operating as a sole trader or partnership

- Self Employed Companies Pty Ltd

- Trading under a Family or Unit Trust

- Preparation of Management Reports

Completing your BAS is a crucial step that must be taken regularly or annually.

If you or your business is registered for GST, your Business Activity Statements (BAS) should be lodged monthly, quarterly or annually.

Your BAS will help you report and pay you:

- goods and services tax (GST)

- pay-as-you-go (PAYG) instalments

- PAYG withholding tax

- other taxes.

At Oyster Hub, we can automatically send you a BAS as soon as you register for an Australian business number (ABN) and GST.

Our expert tax accountants will help you with managing the ATO lodgement process to meet your ATO obligation for Goods and Services Tax (GST), Pay as you go (PAYG) income tax instalment, Pay as you go (PAYG) tax withheld, Fringe Benefits Tax (FBT) instalment, Luxury Car Tax (LCT), Fuel Tax Credits, Instalment Notices for GST and PAYG Instalments.

Our team of experienced self-managed super fund accountants can help you navigate the complexities of setting up and auditing self managed super funds with ease.

If you are providing your employees with non-income benefits, determine which non-income benefits are exempt and which ones require FBT returns to be lodged with the help of your accountant.

If you have outstanding ATO lodgements, paying high tax bills or having low business cashflow you require rescue tax accountant.

Rescue Accounting Is Very Specific To You, However Entails Some Facets Throughout Below:

Disorganisation In The Office And Missing Paperwork

If you are struggling to to locate particular invoices or struggling with office organisation and filing, we can help getting everything in place.

Incorrectly Paying GST, PAYG And Super

Errors in reporting can arise from incorrect set up and allocations. We can review your setup and make necessary adjustments before your next BAS lodgement.

Fines, Penalties And Interest

Dealing with the ATO and Fair Work can be stressful and hence, you guessed it; it can cause negative impact on your bank balance. We can bring everything back on track.

Can’t Make Financial Decisions

Good financial decisions cannot be made if your accounts are wrong. We will ensure precise information and reporting, so you can make informed decisions towards your next steps.

Are you feeling overwhelmed by tax debt and being hounded by the ATO? Let Oyster Hub ease your burden with our seven-step process. Our expert tax accountants will thoroughly review your entire tax situation and determine the best course of action, whether it be negotiating an ATO Payment Plan or ATO Tax Debt Negotiation. Don’t wait until it’s too late.

Our team has helped countless struggling small businesses in similar situations. If you are struggling with ATO payment plan you need someone to represent your case to the ATO, trust us to manage your tax debt payment plan to keep your livelihood intact.

How our expert tax accountants can help you:

- Comply with your outstanding business obligation

- Seeking finance options to pay your ATO tax debt & payment plan

- Negotiate on payment plan arrangements

- Apply for remissions of General interest charges

- Remission of failure to lodge penalties

- Negotiate Director Penalty Notices

- Business viability assessment for ATO

When it comes to managing your Self-Managed Superfund (SMSF), tax returns and audits are essential tasks that require precision and expertise. Oysterhub specialise in providing comprehensive tax return and audit services specifically tailored for SMSFs, ensuring your fund remains compliant and optimised for financial growth.

With over 200 tax saving strategies our aim is to ensure that you don’t pay no tax rather have effective tax planning strategies in place so you don’t pay not a cent more than required!

If you are employing people in your business, it is essential to comply with Single Touch Payroll (STP) reporting. This means lodging every payroll cycle on the Australian Taxation Office (ATO). This includes:

- Gross Payment

- Paid Leave (including subcategories like paid parental leave, workers’ compensation leave, and more)

- Allowances (including cents/km, laundry and others)

- Overtime

- Bonuses and commissions

- Directors’ fees

- Return-to-work payments

- Salary sacrifice.

If you’re running a business and haven’t yet implemented an STP software like QuickBooks Online yet, it can be challenging to meet these reporting requirements. Contact us now for further assistance.

It’s your responsibility to pay for super funds to your eligible employees at least 4 times a year. These payments must be received by the fund on or before the quarterly due dates to avoid any chargesfrom the day your employees start working for you. The due dates occur quarterly.

Quarterly super payment due dates:

If you’re having trouble keeping up with your superannuation reporting and payments, consider using an online payroll software to make the process easier.

Save time, be compliant and empower your employees by using cloud payroll software like XERO & QuickBooks.

The cloud software will manage the following:

- STP compliance and ATO reporting

- Superannuation reporting

- Superannuation payments

- Employee portal

- Rostering & wage overviews

Review all your insurance policies especially workers compensation, check if all your employees are covered and make sure you have the right level of cover so that you are compliant in case of any unexpected dilemmas.

02

Managing Payroll Compliance & Reporting

If you are a small business owner who has employees, you are required to manage the following payroll compliance.

This will help identify future revenue and expenditure trends that may have an immediate or long-term influence on government policies, strategic goals, or community services. The forecast is an integral part of the annual budget process. An effective forecast allows for improved decision-making in maintaining fiscal discipline and delivering essential community services.

03

ACNC, ORIC & ASIC Reporting Compliance

Accurate expense tracking forms the bedrock of reliable business bookkeeping. This fundamental practice plays a critical role in monitoring business growth, constructing financial statements, documenting deductible expenses, facilitating tax return preparation, and ensuring the legitimacy of your filings. Here are the various types of receipts:

A company is viewed as a separate legal entity, which is great for asset protection but unfortunately comes with a significant amount of extra reporting to the ASIC that’s required.

ASIC want to know everything about the shareholders’ address, birth history, residence and the financial position of the company itself.

If you’re not familiar with, or trained to complete these obligations, you may miss important deadlines and find the additional administration taking up more of your time than you have available.

By working with Carbon, you’ll be able to put these tasks into our capable hands and know they are being completed correctly, and on time.

To ensure you remain compliant with your obligations, we can help with:

- Fulfilling all ASIC lodgment requirements.

- Completing annual reviews.

- Maintaining company records.

- Preparation and filing of Directors Meeting Minutes.

- Creation and lodgment of company share changes.

- Processing company de-registrations.

If you are operating as a nonprofit organisation or a charity, you must submit an annual report to the ACNC to maintain their registration.

Some charities may be required to submit an annual financial report and even, maintain other ongoing obligations to the ACNC. These include keeping financial and operational records up to date, informing the ACNC of any changes to charity details, and complying with the Governance Standards as well as the External Conduct Standards, if applicable.

Corporations under the CATSI Act are required to report under it to adhere to the Act and Regulations. Although it is not explicitly stated whether CATSI corporations are reporting entities, the Act and Regulations mandate the preparation of a financial report in compliance with accounting standards, regardless of its reporting status.

CATSI corporations are required to prepare a financial report that complies with accounting standards, as if they were a reporting entity,

Section 21 of the CATSI Regulations outlines the contents of a financial report, which include financial statements –s. 21(3) and notes—s. 21(5) that adhere with accounting standards. Additionally, a director’s. These requirements align with a general-purpose financial report.

Starting your business at home is a great way to keep overhead low, plus you’ll qualify for some unique tax breaks. You can deduct the portion of your home that’s used for business, as well as your home internet, cell phone, and transportation to and from work sites and for business errands.

Why Invest In Our Proactive Tax Accounting

Investing with a proactive tax accountant ensures you meet all your ATO obligations efficiently and avoids your business from facing any unwanted penalties and closure. Below are the reasons why you want to invest with our tax accountants:

Keep the ATO off your back with our compliance strategies tailored for you. We guarantee you that you will never get a negative ATO call for not complying with your obligations.

We use cloud based reporting systems, which you have 24/7 access to your entire business database, enabling you to analyse your business numbers at any point in time you want.

Having real time access to financial information enables you to make tailored financial decisions early to focus on growing your business to the next level via numerous strategies.

Eliminate paperwork and shoebox receipts through our cloud based systems enabling you to automate book-keeping processes and give you extra time to ensure growth within your business.

Why Choose Oyster Hub Wizard Accountants ?

Managing your business’s finances can be overwhelming. With Oyster Hub, our award-winning accountants can provide expert aid and support to help you expand your business while maintaining complete tax compliance.

When you work with us, you are bound to get the best results. Whether you need help with bookkeeping, tax planning, or financial reporting, we’ve got you covered.

Oysterhub understands the importance of effective communication for successful business operations. Our team of experts is well-versed in cloud technology and proficient in utilizing video conference platforms like Zoom and Microsoft Teams Meetings so you can you can connect and collaborate with us seamlessly from anywhere you are.

Oysterhub does not only take your small business and startup to new heights. We empower every small business owner to unlock their inner wizardry, enabling them to achieve their goals while making a profound social impact in their communities.

Moreover, we are proud advocates of the UN’s Sustainable Development Goals— inspiring our clients to amplifying their value and impact while driving positive change in the world.

Every businesses comes face to face with unique challenges when it comes to managing their accounting, bookkeeping, and finance needs. Our team of experienced professionals go beyond simply crunching numbers and tailor our services accordingly, allowing you to focus on what matters most: driving your small business towards unparalleled growth and scalability.

Sorting out payroll, taxes, and accounts can be an arduous task and could be better spent on completing new projects.

Countless clients have experienced a significant boost in revenue by redirecting their focus back into their core operations while allowing our skilled accountants to handle their financial matters. When you partner with us today, you will experience the difference our expertise can make for your business while providing additional support to fuel your business’s growth.

Clear financial records are the compass that guides successful businesses towards profitability. At Oyster Hub, our experienced accountants specialise in putting your financial records back on track.

In a world brimming with opportunities, we believe that every individual and business possesses a unique Pearl waiting to be discovered.

From managing budgets to optimizing staff resources and closely monitoring your profit and loss, we provide the insights you need to drive your business forward.

Let Oyster Hub be your trusted guide in uncovering the hidden treasures within your business and life. We will focus on finding your pearl so you can enjoy doing the things you love the most.

In the aftermath of the COVID-19 pandemic, numerous business owners find themselves grappling with tax debts, causing significant financial strain. Our expert team is dedicated to surmounting these tax debt hurdles by implementing highly effective strategies tailored to your unique circumstances.

If you find yourself being hounded by the Australian Taxation Office (ATO) and have received distressing correspondence and notices, it is crucial to take immediate action.

Did you know that a staggering 80% of errors in small business finances are directly related to bookkeeping and tax? These mistakes can have a significant impact on your bottom line, leading to penalties, fines, and even potential legal consequences.

Running a business is no easy feat. At Oysterhub, we specialize in helping small businesses regain control of their financials— from struggling with bookkeeping, overdue tax lodgements, mounting ATO debts, and dwindling business cashflow. Our tailored solutions are designed to address your specific needs for regaining control and working towards resolving ATO tax debts.

Get a SECOND rescue opinion for your Small Business for your previous year’s tax returns if you have PAID High Tax Bills.

We find that most business owners are heading toward a business crisis if they identify the following in your business.

Drowning In Paperwork

Low Business Cashflow

Paying High Tax Bills

Accountant is working like a sloth

Need an expert wizard?

Come and have a chat with our friendly staff about your next big steps.

Feeling lost? here are some related tags to help you navigate!

GET TO KNOW US MORE

Learn more about our Award Winning Service

Your business is a journey; create an impact and build a business that has a purpose to make a difference to your family, community, and yourself. We have put together everything you need to know about how we create an impact at Oyster Hub with ‘Your Journey with Oyster Hub Guide.’ Download the PDF and learn more about how you can create an impact in your business

Previous

Small Business Tax Accounting

Next

What People Love About Us

I have never found a more passionate finance broker than Vik and his team at Oysterhub. We were about to lose our house when our business took a down shift. Vik saved us from getting a finance deal approved when banks shut the door at us. It's great to work with people who actually care about people not just profits.

I have never seen someone more passionate tax accountant than Adarsh about wanting to help people save time on their menial processes - makes me wonder the experiences in business he has gone through but I'm not complaining I am thankful for it. He is the only tax accountant who has helped me save an extra 8-10 hours per week on lazy accountant tasks and facilitate in enabling me to put these tasks to more productive areas.

- See More